It's Time for a Change

01 April 2009

On

December 8, I wrote that

the praise for “Obama’s initial slate of financial

appointments has been almost unanimously effusive.

But not from me.” I lamented “that a great

opportunity was missed – the appointment of

Joseph Stiglitz

to

either Treasury Secretary (instead of Timothy

Geithner) or head of the National Economic Council

(instead of Larry Summers).”

Almost four months and hundreds of billions of misdirected dollars later, I feel even stronger about what might have been. But see what you think. Consider what has been done by our crack economic team since January 20 in attempting to solve our financial mess. Then look at the results so far (by whatever metric you wish to choose). Finally, read Stiglitz’s op-ed piece in today’s New York Times, “Obama’s Ersatz Capitalism.”

He describes the administration’s proposal to deal with the ailing banks as one that replicates “the flawed system that the private sector used to bring the world crashing down…overleveraging in the public sector, excessive complexity, poor incentives and a lack of transparency…

“What the Obama administration is doing is far worse than nationalization: it is ersatz capitalism, the privatizing of gains and the socialization of losses. It is a ‘partnership’ in which one partner robs the other. And such partnerships – with the private sector in control – have perverse incentives, worse even than the ones that got us into this mess.” [Emphasis added]

The appeal of such a proposal? He describes it as a “kind of Rube Goldberg device that Wall Street loves – clever, complex and nontransparent, allowing huge transfers of wealth to the financial markets.”

As to the alternative of temporary nationalization, Stiglitz suggests that “that option would be preferable to the Geithner plan. After all, the FDIC has taken control of failing banks before, and done it well. It has even nationalized large institutions like Continental Illinois (taken over in 1984, back in private hands a few years later), and Washington Mutual (seized last September, and immediately resold).”

As I mentioned in my December piece, Stiglitz was shut out of the administration’s economic team because of longtime bad blood between him and Summers (the same issue that has kept Paul Krugman on the sidelines). But it’s not too late for the administration to admit mistakes of commission and omission. Should they make a change in our economic leadership? Yes. Will they make a change? Alas, no. In Washington, politics trumps rationality.

Wall Street and the Automobile Industry

The U.S. automotive industry is now being “overseen” by Steve Rattner, head of an leveraged-buyout firm (pardon me, private equity). Chrysler was purchased two years ago by an LBO firm (oops, there I go again) started by a former Drexel bond trader. General Motors was run for almost two decades by a former finance guy, a long tradition at GM. (At least Ford’s CEO had built something tangible before – airplanes.) However the industry emerges from its current dysfunction, is there any reason to believe that there’s anyone in charge today who knows the first thing about running a successful auto manufacturer; someone who can design and build cars that people want without rebate incentives; someone who can recapture the two generations of youth that have eschewed the American automobile?

There are those students of management who believe that any good manager can manage a company in any industry. Call me crazy, but I always thought that one should know something about the business one runs. (Come to think of it, real-estate moguls running newspaper companies haven’t been too successful, either.)

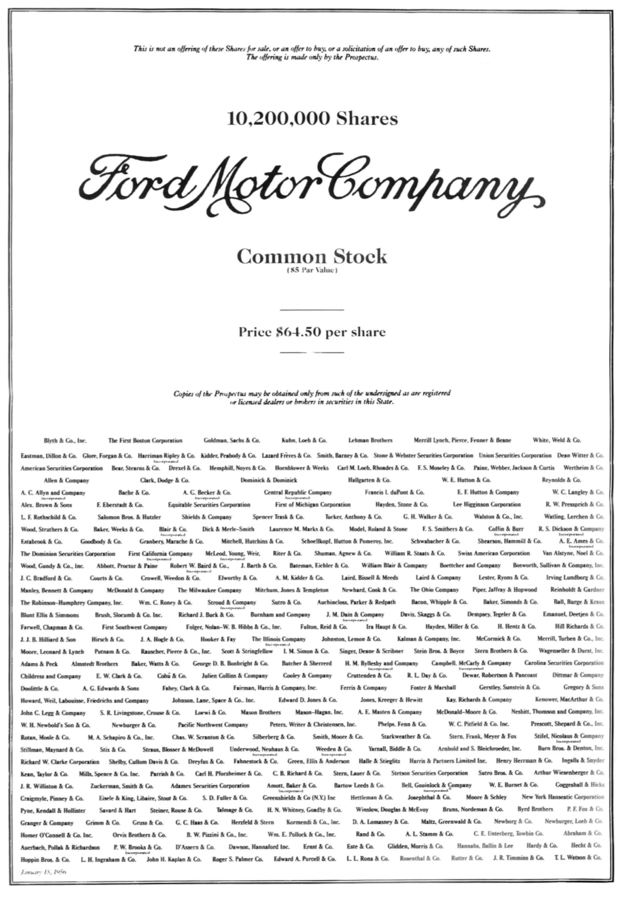

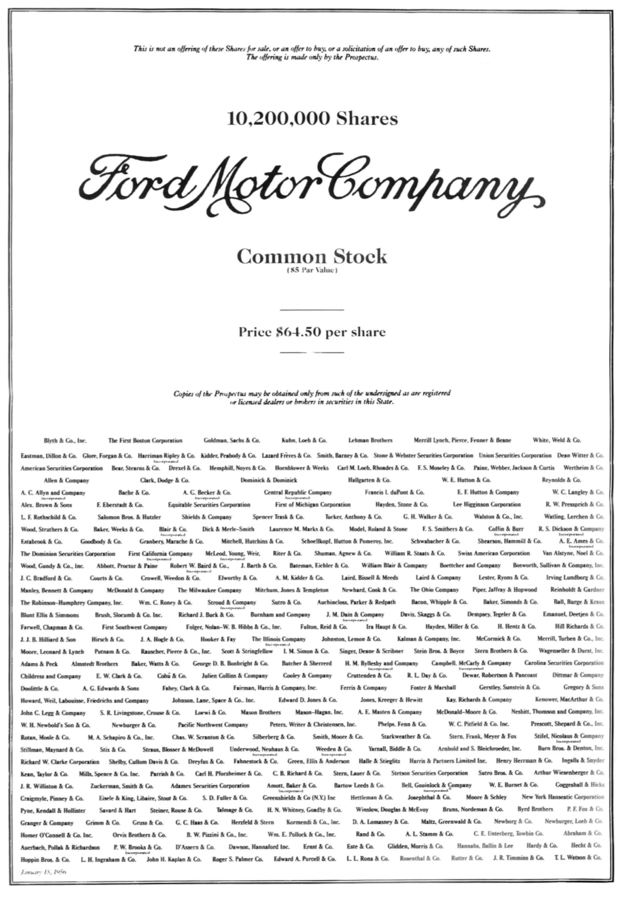

Speaking of the auto industry and of Wall Street, the then family-owned Ford Motor went public on January 17, 1956, in one of the largest IPOs ever (to that date). It was not only large in dollars, $658 million, but in the size of the underwriting syndicate. Over three hundred broker-dealers participated in the offering. (Apologies for the poor quality of the tombstone; your eyes are OK.)

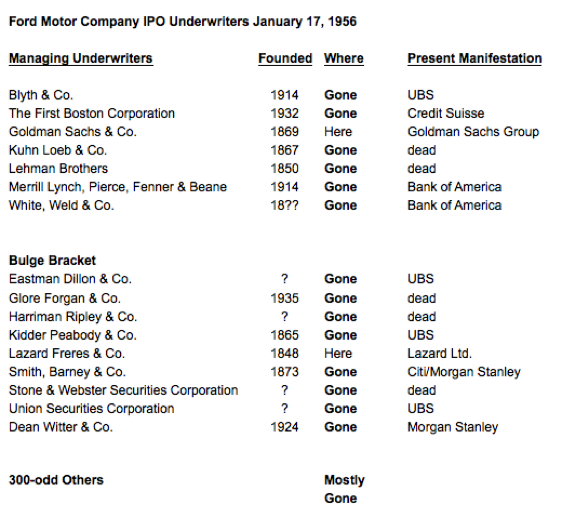

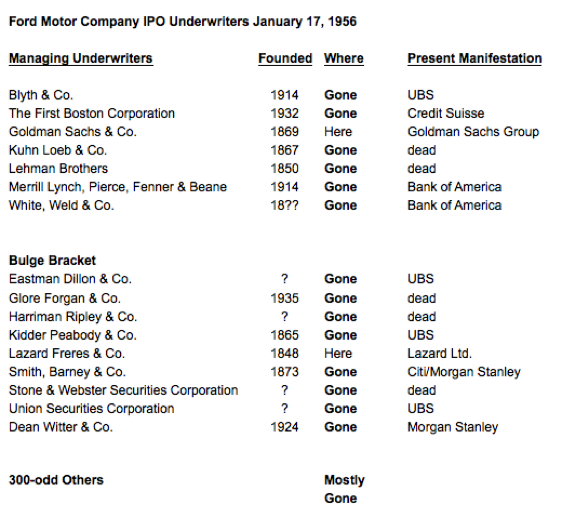

Well, we know what’s happened to Ford and to the auto industry since then, and it’s not pretty. But what about all those securities firms that helped make Ford a public company? That’s not pretty a pretty sight, either.

There were seven managers of the offering: Blyth, First Boston, Goldman Sachs, Kuhn Loeb, Lehman, Merrill Lynch, and White Weld. Today, only Goldman Sachs remains; the others all died or were acquired. Of the eight firms in the next largest allocation bracket, only the name Lazard remains today as an independent entity (they’ve jettisoned the Frères from their earlier name.)

As to the other 300 or so national and regional firms, most have long ascended into that Great Stockmarket in the Sky. It’s sure a different business today from when I was plying the Street in the 60s and 70s as a technology analyst. Very few IPOs, fewer still underwriters, and even fewer technology analysts.

My Favorite Bank Advertisement of the Month

Bank of America ran a full-page in newspapers around the country with this opening line:

“We’re taking the trust and faith that America has put in us and getting to work…”

The “trust and faith” that we put into you? As John McEnroe might say, “Are you kidding me?”

This rather presumptuous claim almost rivals the one in Bernie Madoff’s pre-incarceration letter to fellow apartment owners at 133 E. 64th St. apologizing for the media frenzy in front of the building

Dear neighbors,

Please accept my profound apologies for the terrible inconvenience that I have caused over the past few weeks. Ruth and I appreciate the support we have received.

Best Regards,

Bernard

“Support we have received?” "Trust and faith put into us?"

Bizarre, or what?

Where Maureen Gets Her Material

With this economy, as William Goldman famously said of Hollywood, “Nobody knows anything.” [Emphasis added.]

In 1983, screenwriter William Goldman (Butch Cassidy, Marathon Man, All the President’s Men, Princess Bride, et al.) wrote Adventures in the Screen Trade, a brilliant and entertaining analysis of the movie industry. His unforgettable takeaway line that summarized the entire 436-page book, the phrase that captured the essence of Hollywood, and now the single best explanation of why we’re in such an economic mess: “Nobody knows anything.”

Through Rosen-colored Glasses, September 24, 2008

By the way, Maureen, just to pick a grammatical nit, Bill Goldman didn’t famously say “nobody knows anything.” He happened to coin a phrase that became famous.

And another BTW: There is somebody who does know something: Joe Stiglitz. He just happens not to be where we need him.

Almost four months and hundreds of billions of misdirected dollars later, I feel even stronger about what might have been. But see what you think. Consider what has been done by our crack economic team since January 20 in attempting to solve our financial mess. Then look at the results so far (by whatever metric you wish to choose). Finally, read Stiglitz’s op-ed piece in today’s New York Times, “Obama’s Ersatz Capitalism.”

He describes the administration’s proposal to deal with the ailing banks as one that replicates “the flawed system that the private sector used to bring the world crashing down…overleveraging in the public sector, excessive complexity, poor incentives and a lack of transparency…

“What the Obama administration is doing is far worse than nationalization: it is ersatz capitalism, the privatizing of gains and the socialization of losses. It is a ‘partnership’ in which one partner robs the other. And such partnerships – with the private sector in control – have perverse incentives, worse even than the ones that got us into this mess.” [Emphasis added]

The appeal of such a proposal? He describes it as a “kind of Rube Goldberg device that Wall Street loves – clever, complex and nontransparent, allowing huge transfers of wealth to the financial markets.”

As to the alternative of temporary nationalization, Stiglitz suggests that “that option would be preferable to the Geithner plan. After all, the FDIC has taken control of failing banks before, and done it well. It has even nationalized large institutions like Continental Illinois (taken over in 1984, back in private hands a few years later), and Washington Mutual (seized last September, and immediately resold).”

As I mentioned in my December piece, Stiglitz was shut out of the administration’s economic team because of longtime bad blood between him and Summers (the same issue that has kept Paul Krugman on the sidelines). But it’s not too late for the administration to admit mistakes of commission and omission. Should they make a change in our economic leadership? Yes. Will they make a change? Alas, no. In Washington, politics trumps rationality.

Wall Street and the Automobile Industry

The U.S. automotive industry is now being “overseen” by Steve Rattner, head of an leveraged-buyout firm (pardon me, private equity). Chrysler was purchased two years ago by an LBO firm (oops, there I go again) started by a former Drexel bond trader. General Motors was run for almost two decades by a former finance guy, a long tradition at GM. (At least Ford’s CEO had built something tangible before – airplanes.) However the industry emerges from its current dysfunction, is there any reason to believe that there’s anyone in charge today who knows the first thing about running a successful auto manufacturer; someone who can design and build cars that people want without rebate incentives; someone who can recapture the two generations of youth that have eschewed the American automobile?

There are those students of management who believe that any good manager can manage a company in any industry. Call me crazy, but I always thought that one should know something about the business one runs. (Come to think of it, real-estate moguls running newspaper companies haven’t been too successful, either.)

Speaking of the auto industry and of Wall Street, the then family-owned Ford Motor went public on January 17, 1956, in one of the largest IPOs ever (to that date). It was not only large in dollars, $658 million, but in the size of the underwriting syndicate. Over three hundred broker-dealers participated in the offering. (Apologies for the poor quality of the tombstone; your eyes are OK.)

Well, we know what’s happened to Ford and to the auto industry since then, and it’s not pretty. But what about all those securities firms that helped make Ford a public company? That’s not pretty a pretty sight, either.

There were seven managers of the offering: Blyth, First Boston, Goldman Sachs, Kuhn Loeb, Lehman, Merrill Lynch, and White Weld. Today, only Goldman Sachs remains; the others all died or were acquired. Of the eight firms in the next largest allocation bracket, only the name Lazard remains today as an independent entity (they’ve jettisoned the Frères from their earlier name.)

As to the other 300 or so national and regional firms, most have long ascended into that Great Stockmarket in the Sky. It’s sure a different business today from when I was plying the Street in the 60s and 70s as a technology analyst. Very few IPOs, fewer still underwriters, and even fewer technology analysts.

My Favorite Bank Advertisement of the Month

Bank of America ran a full-page in newspapers around the country with this opening line:

“We’re taking the trust and faith that America has put in us and getting to work…”

The “trust and faith” that we put into you? As John McEnroe might say, “Are you kidding me?”

This rather presumptuous claim almost rivals the one in Bernie Madoff’s pre-incarceration letter to fellow apartment owners at 133 E. 64th St. apologizing for the media frenzy in front of the building

Dear neighbors,

Please accept my profound apologies for the terrible inconvenience that I have caused over the past few weeks. Ruth and I appreciate the support we have received.

Best Regards,

Bernard

“Support we have received?” "Trust and faith put into us?"

Bizarre, or what?

Where Maureen Gets Her Material

With this economy, as William Goldman famously said of Hollywood, “Nobody knows anything.” [Emphasis added.]

In 1983, screenwriter William Goldman (Butch Cassidy, Marathon Man, All the President’s Men, Princess Bride, et al.) wrote Adventures in the Screen Trade, a brilliant and entertaining analysis of the movie industry. His unforgettable takeaway line that summarized the entire 436-page book, the phrase that captured the essence of Hollywood, and now the single best explanation of why we’re in such an economic mess: “Nobody knows anything.”

Through Rosen-colored Glasses, September 24, 2008

By the way, Maureen, just to pick a grammatical nit, Bill Goldman didn’t famously say “nobody knows anything.” He happened to coin a phrase that became famous.

And another BTW: There is somebody who does know something: Joe Stiglitz. He just happens not to be where we need him.

|